stop quote vs trailing stop quote

Stop quotes and stop limit quotes can be an important tool in a traders toolbox when deciding at which price levels to buy or sell into the market. Suppose the price of your security goes way up after you enter the stop order market or limit doesnt matter.

Stop Limit Order Example Free Guide With Charts

For example say you.

. If the calculated stop price is reached the order will be activated and become a market order. They allow you to automate certain processes. It places a limit on your loss so that you dont sell too low.

Since a market order has no conditions as to. The purpose of a stop loss is to keep a loss small while a trailing stop is a way to make a winning trade as big as possible. Think of the stop as a trigger that will initiate the purchasesale and the limit as a condition.

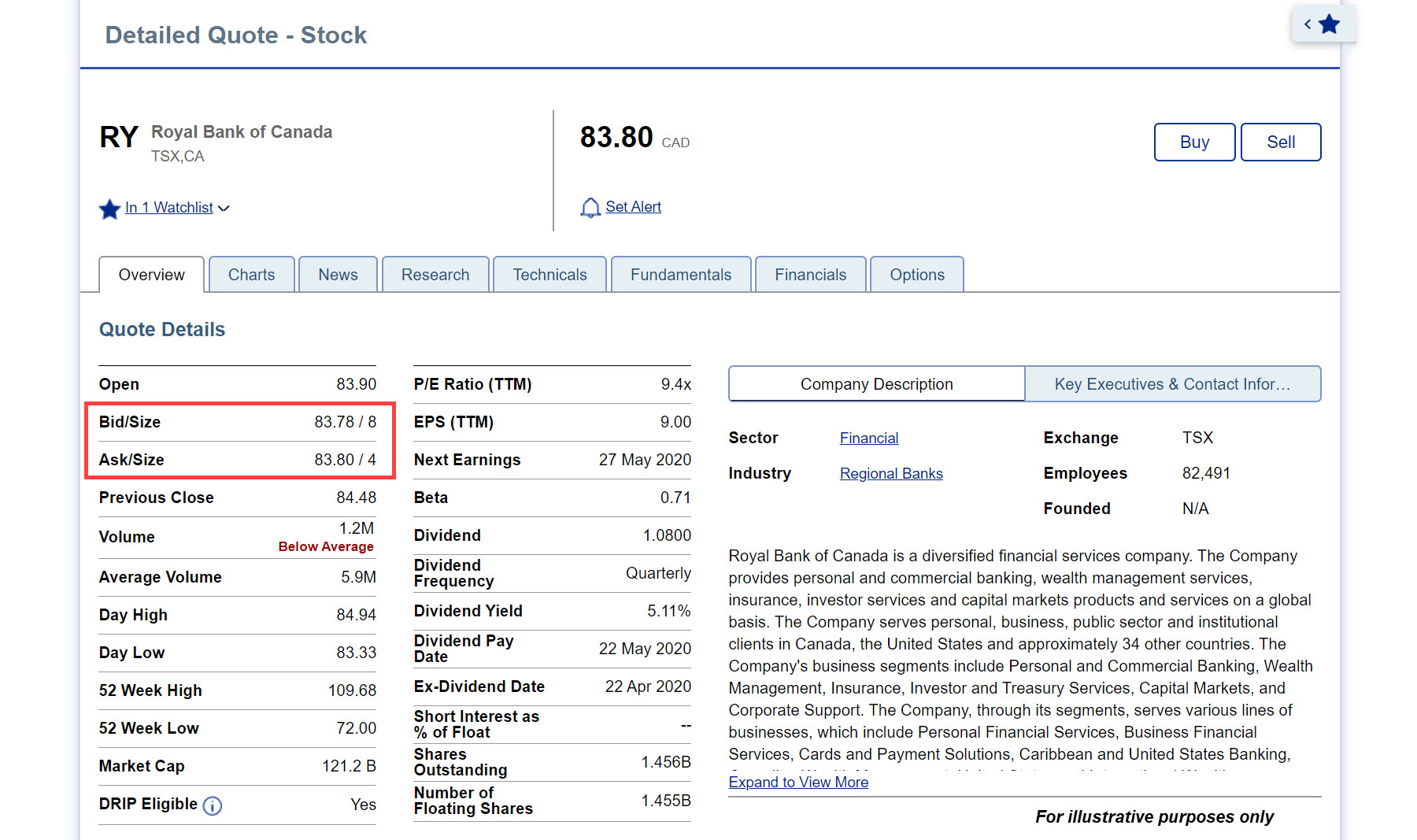

However the stop price will adjust with changes to the national best bid or offer for the security. Stop quote vs trailing stop quote. An investor places a trailing stop for a.

Designed to initiate a sale or. Just use stop orders. The stop order is an order type that immediately sends a market order when the market hits the set stop loss level.

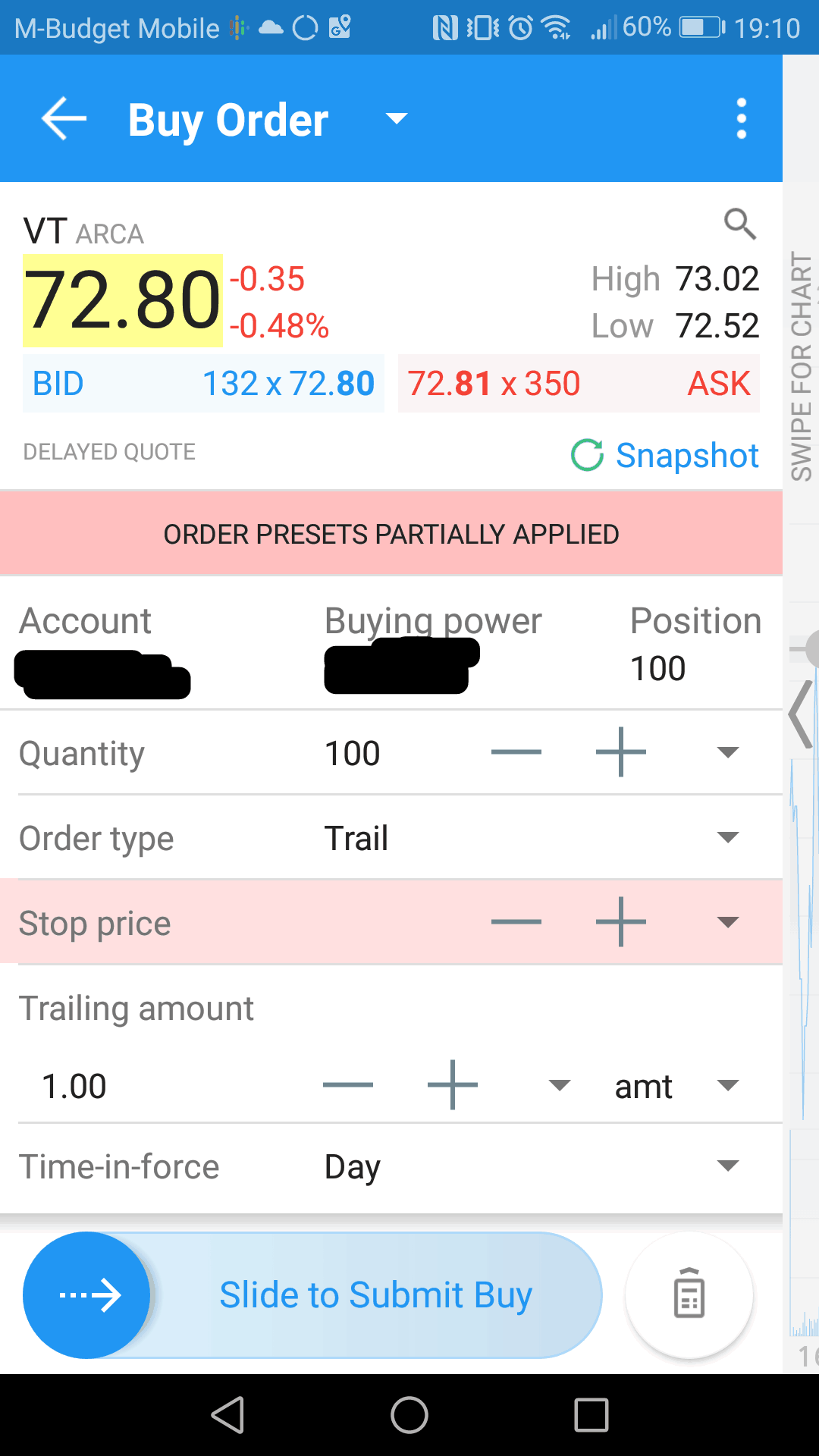

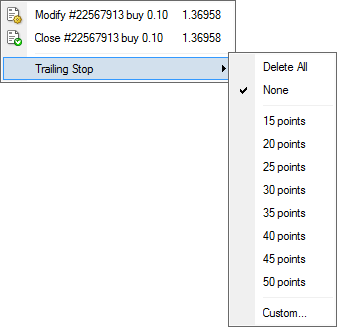

It enables an investor to have some downside protection to sell a stock at their. A trailing stop order is similar to a traditional stop quote order. A trailing stop is a stop order that can be set at a defined percentage away from a securitys current market price.

Stop quote vs trailing stop quote Posts. This effectively guarantees me a minimum gain of 425. Generally a Stop on Quote is called a stop loss or stop order a stop limit on quote is called a stop limit and a trailing stop is well.

Stop on Quote vs. Etrade changed the stop loss function some time ago. An initial profit target on entry is one way to measure.

It lets you accomplish this without continuously watching the price of the stock. Put simply a trailing stop order is a risk. Put simply a trailing stop order is a risk.

A trailing stop limit is an order you place with your broker. A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order.

Bad thing about SLOQ. Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price. The stop-loss order allows me to limit my losses while also allowing me to participate in uptrends as long as they continue without.

For a retail trader like yourself theres no practical benefit to stop limits. Investing 101 Investing Strategies.

What Is Trailing Stop Loss Techniques Pros Cons Elm

The Basics Of Stop Limit Orders In 2 Minutes How To Trade Stop Limit Orders Youtube

Sdk 2 4 Guides User Orders Documentation Openware Documentation

Trading Stocks What You Need To Know To Get Started

Stop Loss Strategy Trailing Stop Limits Orders Explained

2 High Low Candle Trailing Stop Forex Factory

The 5 Most Used Stock Market Order Types For Investing The Poor Swiss

Limit Order Vs Stop Order Difference And Comparison Diffen

Stop Vs Limit Orders What Are The Types Of Orders In Trading Ig International

Trailing Stop With Investor S Edge Canadian Money Forum

Trailing Stop Trading Metatrader 4 Help

3 Order Types Market Limit And Stop Orders Charles Schwab

Trailing Stop Order Vs Stop Loss Order

:max_bytes(150000):strip_icc()/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-3e4697527ad041809b1528ed6d5e0fa2.jpg)

Trailing Stop Stop Loss Combo Leads To Winning Trades

3 Order Types Market Limit And Stop Orders Charles Schwab

Trailing Take Profit Trailing Stop Loss Strategy By Jason5480 Tradingview

Trading With Trailing Stops Using The Matrix Tradestation Desktop